Institutional investors could earn attractive yields and potentially benefit with capital gains should yields decline in the future. The level of yields could also provide a yield cushion should rates continue to rise.

Our Short Duration Plus strategy is capitalizing on the relative value in short duration fixed income, particularly since we believe we are near, or approaching, peak Fed Fund rates. Not only have yields risen to the most attractive levels in over 10 years, we’ve seen the largest moves in 2-year and 5-year Treasury yields.

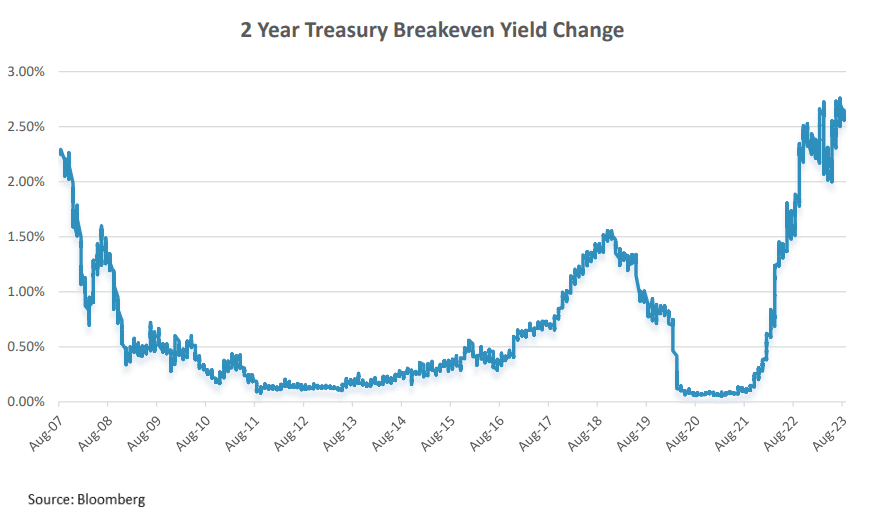

For investors seeking income and/or total return, active strategies can capitalize on this opportunity. Short-dated bonds now have a higher probability of positive returns despite interest rate volatility, given the yield cushion. The following chart showing the breakeven yield change for a 2-year Treasury over a one-year holding period demonstrates the value of this yield cushion.

As the chart shows, for a one year holding period, a 2 year yield would have to rise another 265 basis points from the current yield for the holding period return to be negative. We think this scenario is unlikely given current market pricing and what the Fed is signaling.

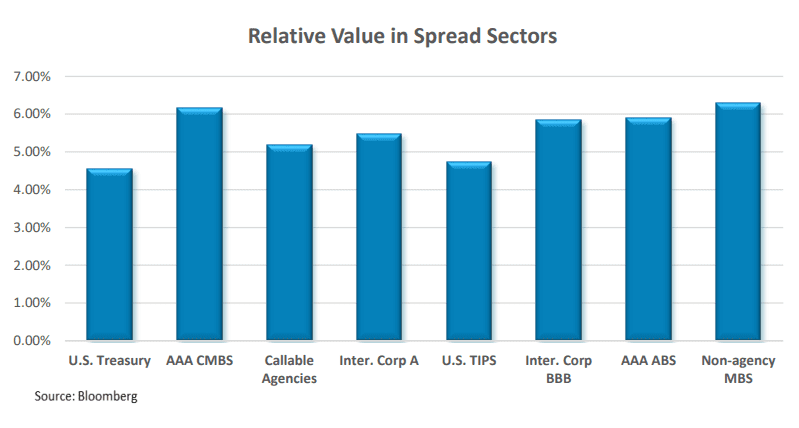

What this means for spread sectors is compelling, in our view. We see active management opportunities in structured products, corporate bonds, and callable agencies. In particular, we believe select AAA-rated structured products such as non-agency mortgages, CMBS and ABS generally offer attractive risk-adjusted returns versus corporate credit; the potential for deterioration in credit conditions clearly is a risk that we wish to avoid.

In the NCA Short Duration Plus strategy, sector exposures are tactically managed based on such assessments of risk-adjusted relative value. Further, consistent with our investment philosophy, we seek to generate consistent excess returns over time by constructing portfolios with multiple, active diversifying exposures. We focus on a broad opportunity set, as opposed to making a few big bets, in order to limit downside risk.

Important Investment Information

Past performance is no indication of future results. There is no guarantee that the investment objective of the strategy will be achieved. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Clients must be prepared to bear the risk of a total loss of their investment. The themes and strategies and asset allocations herein are not to be construed as recommendations. They are for illustration purposes only and subject to change without

notice.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. New century advisors believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions

The discussion of any investments in this presentation is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. The representative investments discussed were selected based on a number of factors including investment process and subject matter applicability. The reader should not assume that an investment identified was or will be profitable. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Certain performance calculations are prepared internally and have not been audited or verified by a third party. The use of a different methodology for preparing, calculating or presenting performance returns may lead to different results and such differences may be material. You may not rely on this presentation as the basis upon which to make an investment decision. Opinions expressed are new century advisor’s present opinions only and are subject to changes based on market, economic and other conditions and may not actually come to pass. Any historical price(s) or values(s) are also only as of the date indicated.

One cannot invest directly in an index. The index/benchmark comparisons herein are provided for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between client accounts and the indices/benchmarks referenced including, but not limited to, risk profile, liquidity, volatility and asset composition. Benchmark and market data is provided by a third party. New century advisors does not guarantee or warrant the accuracy, timeliness, or completeness of third-party information provided and is not responsible for any errors or omissions.

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or proposed by NCA will be profitable or equal any historical performance level(s).

Certain portions of New Century Advisors, LLC newsletters, white papers, etc., may contain a discussion of, and/or provide access to, New Century (and those of other investment and non-investment professionals) opinions and/or recommendations as of a specific prior date. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current opinions and/or recommendation(s). Moreover, no client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from New Century Advisors, LLC, or from any other investment professional. New Century Advisors, LLC is neither an attorney nor an accountant, and no portion of the content included in this document should be interpreted as legal, accounting or tax advice.

No part of this material or any NCA content may be reproduced in any form, or referred to in any other publication, without the express written permission of the New Century Advisors, LLC.