Q2’25 Commentary

Q2 marked the potential end of the longest period of US small cap underperformance relative to large cap since the 1920s. At the start of the quarter, US small caps were hit hard by fears of a recession, inflation, a “higher for longer” interest rate environment and a global trade war. But the Trump Administration’s pause on punitive tariffs a week later sparked a huge rally that continued throughout the quarter. For the month of June, the small-cap Russell 2000 Index beat the large-cap Russell 1000 Index, returning 5.44% vs. 5.06%, respectively. For the quarter, the Russell 2000 was up 8.5% and up almost 24% from its April 8th bottom. The resilience of small caps amidst a whirlwind of macroeconomic and geopolitical headlines underscores the unique opportunities from this relatively undervalued market segment and the potential for sharp recoveries.

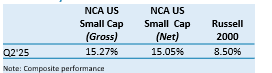

Quarterly Perfomance

As active managers of a low turnover, high conviction portfolio of 25 to 45 holdings, we believe the alpha is in the details. Our disciplined, bottom-up research approach to stock selection means we know what we own. This enables us to take advantage of fear-driven sell-offs and sharp rebounds by opportunistically adding to our positions. One example is Tutor Perini (TPC), a $2.5B market cap, vertically integrated, civil engineering and construction company, operating in the Industrials sector. In reaction to the newly announced US tariffs on April 2nd, TPC sold off over 7% that day, along with its sector, on fears that the cost of manufacturing and construction materials from China would skyrocket. However, we knew that the company’s supply chain is heavily anchored to domestic sources. As a leading contractor for large-scale U.S. public infrastructure projects that rely on federal funding, many of their contracts require them to Buy American. Thus, most of the materials (steel, concrete, etc.) are locally sourced. Knowing that tariffs would have a minimal impact on the company’s financials, we added to our position. The stock subsequently rebounded by over 116% through June 30th.

Small cap investing is not a passive journey. Over 40% of the Russell 2000 companies are non-earners. Looking ahead, we expect market volatility to persist. But as active managers and bottom-up stock pickers, we live in the details and this gives us the conviction to use market downturns to our advantage, to add to our holdings, avoid panic selling and generate alpha for our clients.

Portfolio Attribution Analysis

Q2 proved to be a volatile yet ultimately rewarding period for the small-cap Russell 2000 Index with the winners concentrated in cyclical and growth-oriented areas of the market. IT, Industrials, and Materials were the best performing sectors, returning 21.3%, 15.6% and 13.0%, respectively. The reshoring of manufacturing and increased capital investment provided a tailwind for many industrial companies, while the return of the AI trade gave a boost to the IT sector. The worst performing sector was Real Estate, returning -1.82%, followed by Utilities and Energy, returning -1.28% and -1.07%, respectively. These more defensive and rate-sensitive sectors struggled and Energy stocks were weighed down by volatile commodity prices.

In the NCA US Small Cap strategy, stock selection continued to be the primary driver of outperformance, contributing a net +610 bps. Stock selection in Industrials, Financials and Consumer Discretionary were the main contributors. Selection in Materials, IT and Energy were the main detractors. The top five performing stocks in the portfolio had a combined contribution to return of 838 bps. Tutor Perini (TPC) as discussed earlier, was the top contributing position, followed by Shake Shack (SHAK), Comfort Systems (FIX), Donnelley Financial (DFIN) and SPXC Technologies (SPXC). The bottom five performing stocks had a combined contribution to return of -124 bps, including one position that we exited in the quarter, Oxford Industries (OXM). Despite the company’s strong balance sheet and margin-improving operational initiatives, we believe the overriding negative sentiment on higher-end retail, such as OXM’s Tommy Bahama and Lilly Pulitzer, will continue to be an overhang on the stock.

Sector allocation contributed a net +74 bps. The overweight in Industrials and underweight in Energy and Real Estate were the main sector contributors. The overweight in Consumer Staples and underweight in IT and Communication Services were the main sector detractors.

Important Disclosures:

PAST PERFORMANCE IS NOT AN INDICATOR OF FUTURE RESULTS. An investor should carefully consider the Strategy’s investment objective, risks, charges and expenses before investing. One cannot invest directly in an index. There is no guarantee that the investment objective of the strategy will be achieved. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Period data over one year is annualized. You should not rely on this document as the basis upon which to make an investment decision. The Strategy’s return may not match the return of the underlying index. Investing involves risk, including possible total loss of principal.

The principal risks of investing in this strategy include: Equity securities risk, Sector Risk, Non-diversification Risk, Effects of Compounding and Market Volatility Risk, Market Risk, Counterparty Risk, and Rebalancing Risk, which can increase volatility. The Strategy may invest in derivatives, which are often more volatile than other investments and may magnify the Strategy’s gains or losses.

The performance returns contained the deduction of advisory fees, which will reduce the return. The deduction of advisory fees and the compounding effect thereof over time will reduce the total return on any account. For example, an account of $10 million with a 1% fee that experienced a 10% compounding annualized total return over a period of five years would result in an ending dollar value of $16,105,100 without the deduction of advisory fees. If an annual advisory fee of 1% were deducted from the account for the same five-year period, the annualized return would be 9%, with an ending dollar value of $15,315,789. Additional information regarding policies for calculation and reporting returns is available upon request. Additional fees may apply, including brokerage and custodian fees, settlement fees, interest charges, wire fees, transfer fees and fund expenses, incurred in connection with the management of a client’s account.

A FEE SCHEDULE IS AN INTEGRAL PART OF A COMPLETE PRESENTATION AND IS DESCRIBED IN PART II OF THE FIRM’S ADV, WHICH IS AVAILABLE UPON REQUEST. RETURNS INCLUDE THE REINVESTMENT OF DIVIDENDS AND OTHER EARNINGS, WHERE APPLICABLE.

Certain performance calculations are prepared internally and have not been audited or verified by a third party. The use of a different methodology for preparing, calculating or presenting performance returns and portfolio characteristic data may lead to different results and such differences may be material. “Representative Account(s)” discussed were selected based on a number of factors including, length of time in the composite and investment guideline applicability.

HOLDINGS AND SECTOR WEIGHTINGS – Sector and Holdings are subject to change and are not buy/sell recommendations. An investor should consider their objectives, financial situation or needs and risk profile before making any investment decision.

The information contained in this document may not be reproduced or provided to others without the prior written permission of New Century Advisors, LLC. The information provided is neither an offering nor a solicitation of an offering for any securities.

Prior to June 2023 the US Small Cap Strategy was known as the US SMID Cap Strategy and the prior benchmark was the Russell 2500. The benchmark was changed to reflect the portfolio characteristics.