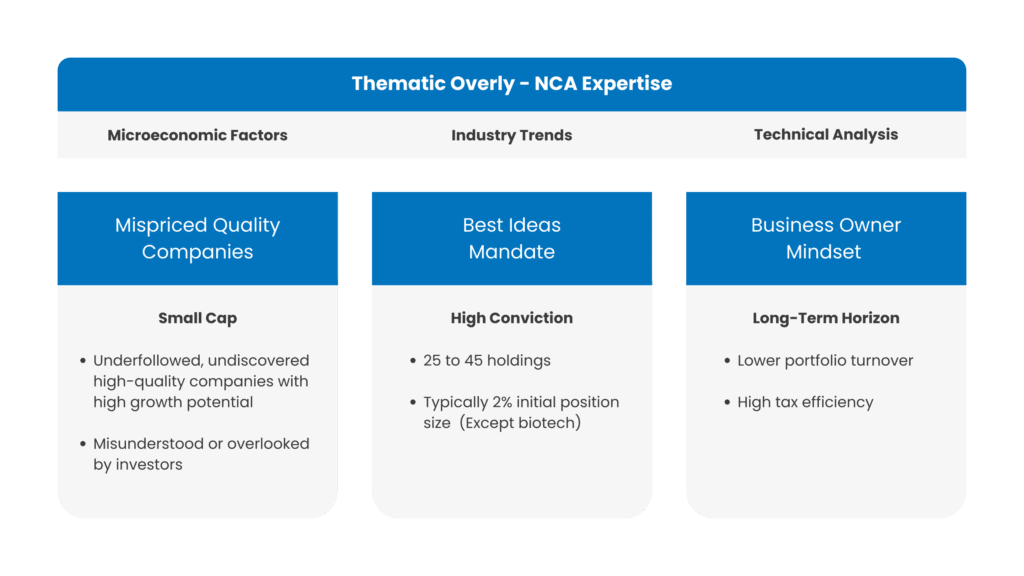

“Our investment philosophy combines bottom-up stock selection with a top-down thematic overlay. We incorporate macroeconomic insights, industry, and technical analysis to identify mispriced quality companies. With a concentrated portfolio and a long-term business owner mindset, we aim for consistent outperformance and value creation.“

Christine Song, CFA

US Small Cap Portfolio Manager

Our Strategy

In a market of thousands, we own the few that matter.

The Russell 2000 Index holds two thousand small-cap stocks. We reject the idea of owning the market. Instead, we believe that to outperform the benchmark, you cannot look like it.

We manage a long-only concentrated portfolio of 25 to 45 of the most promising and overlooked businesses poised to lead tomorrow. We do exhaustive, bottom-up research with top-down thematic overlays to identify America’s next great companies. We invest with conviction, selecting only the best ideas for the portfolio, and we invest for the long term.

Our Philosophy

Built on three pillars of disciplined active management.

Concentrated Conviction

We find strength in focus. Our portfolio is a reflection of our best ideas — 25 to 45 high quality U.S. small-cap stocks. Our concentrated portfolio is the product of radical focus and this means every company we own is one we know well, and believe has the potential to generate long-term value. Every holding is a high-conviction thesis, deeply understood and continuously vetted.

Bottom-Up Fundamental Research with Top-Down Overlays

Our advantage comes from rolling up our sleeves and doing the work. We combine bottom-up insights with top-down thematics. We talk to management teams, build financial forecasts, analyze cash flows, and stress-test balance sheets to find businesses with durable competitive advantages trading at a discount to their intrinsic worth.

Long-Only, Long-Term As long-only managers, we partner with exceptional companies, allowing our investment thesis to play out and compound value for our clients over time. We have the patience of ownership and our success is tied to the growth of the businesses we own. This long-term perspective allows us to be opportunistic when fear rules the markets and we let our winners run and compound over time.