Given the importance that the inflation outlook has on the monetary policy outlook and on financial markets more broadly, it’s important to understand exactly what TIPS prices are telling us.

Introduction: Rich TIPS!

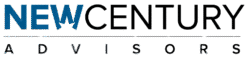

There’s been a lot written about the TIPS market lately, in particular about how rich they’ve become. Thanks in part to easy monetary policy, ongoing fiscal stimulus, and rising commodity prices (particularly oil), the breakeven spreads between the U.S. Treasury’s nominal and inflation-linked debt have risen sharply. A proxy for inflation expectations, TIPS breakevens briefly traded below 1% during the lockdowns a year ago but have since recovered, surpassing pre-pandemic levels. 10yr breakevens trade at 2.27%, just off new eight year highs. Meanwhile 5yr breakevens trade even higher, at 2.59%, their highest level since before the Great Financial Crisis!

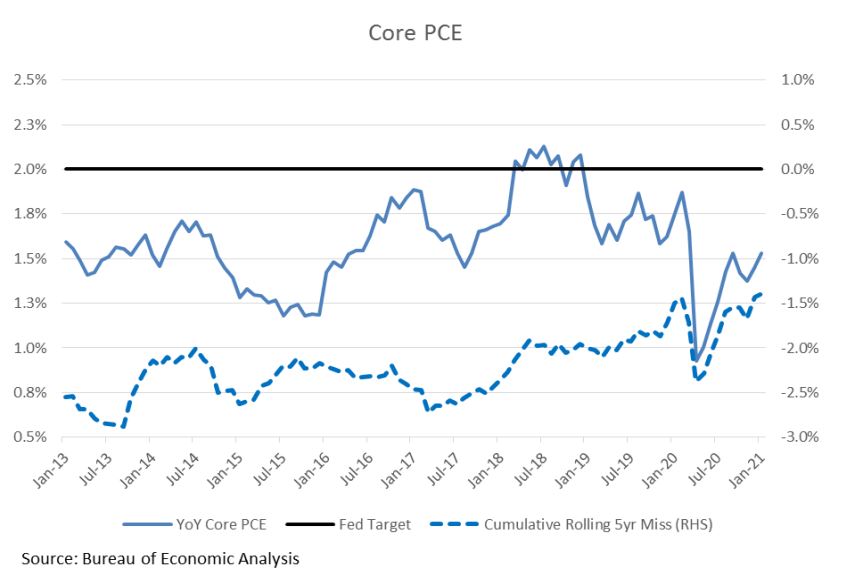

The impact of the reflation trade has been felt far beyond just the TIPS market, pushing nominal interest rates higher and putting downward pressure on equities, growth stocks in particular given the more distant nature of their expected cash flows. The market also brought forward the timing of the Fed’s expected tightening, with three rate hikes now priced in for 2023 vs. none just a couple months ago.

In recent days and weeks a number of sell-side research pieces have said the rise in TIPS breakevens has gone too far, pointing to the 5yr point in particular. The breakeven curve is normally upward sloping, with investors historically willing to pay up to hedge inflation risk further out the curve. In fact, when 5 year breakevens surpassed 10s in the first week of January, it was the first time since 2008 – prior to the Global Financial Crisis – that the breakeven curve had inverted. At -30bps today, it sits at an all-time

record!

Given the importance that the inflation outlook has on the monetary policy outlook and on financial markets more broadly, it’s important to understand exactly what TIPS prices are telling us.

What is Actually Priced into TIPS?

In a word, carry…lots of carry.

Here’s where we get a little technical. In addition to paying investors a coupon, TIPS also pay inflation. Every month, TIPS accrue interest based on the prior month’s CPI print (specifically, the non-seasonally adjusted, or NSA series). January CPI, reported in February, accrues to TIPS in March. The February CPI report was released just this week and will accrue to TIPS in April. As such, we know enough currently to calculate TIPS’ exact value, including carry, out to May 1st. Beyond that will depend on what happens to

CPI going forward.

The beginning of the year often sees a big jump in non-seasonally-adjusted CPI and this year was no different. NSA CPI rose 0.43% MoM in January and another 0.55% MoM in February, the biggest twomonth increase to start the year since 2018. Those gains accrue to TIPS in March and April, raising the value of their principal. 5yr TIPS will earn 16bps of inflation carry between now and May 1st. The carry for longer-dated TIPS is a little less, with 10yr TIPS earning 7.5bps of inflation interest between now and May 1st while 30yr TIPS will earn a little less than 3bps.

As with any market, TIPS price in that carry ahead of time. As that carry rolls in, the quoted prices for TIPS adjust accordingly, as do their yield. Think of it like stocks trading ex-dividend. In months of aboveaverage inflation accrual, the elevated carry is offset by a rise in TIPS yields, pushing the breakeven spread lower. Today’s 2.59% 5yr breakeven is equivalent to 2.48% on May 1st after adjusting for that carry. 10yr breakevens at 2.27% today drop to 2.22% when calculated as of May 1st, while the 30yr drops from 2.20% to 2.18%. So all else equal, not only will breakevens naturally drift lower in the weeks ahead, but the breakeven curve should also become less inverted.

Of course, all else is never equal – markets can and will move in the meantime. But all we can do is try and understand what is priced in today.

Using our forecast for the next few CPI prints, we can extend this analysis even further ahead. NCA’s CPI model currently has NSA CPI rising another 0.58% in March followed by a 0.39% gain in April. Much of the expected gain comes from the ongoing rise in gasoline prices, which are up over 35 cents in the last four weeks alone. When you add those monthly prints to the base effects from last year’s plunge in prices during the lockdown, NCA’s model sees YoY CPI spiking higher in the coming months, peaking at 3.7% in May. Again, it’s all baked into today’s spot breakeven levels, which will be lower once the pig has finished making its way through the python.

Here’s what the breakeven curve should look like in a few months, based on today’s prices and expected carry going forward. While this is based on NCA’s model estimates for the March and April CPI prints (accruing to TIPS in May and June), street forecasts paint a similar picture

Bringing it Back to the Fed

So depending on the next couple of CPI prints, today’s 2.59% 5yr breakeven equates to ~2.32% on July 1 st. That’s still higher than it’s been in several years, but it merely matches the Fed’s stated inflation target of 2% for Core PCE. (Historically, CPI runs 30-40bps higher than PCE.) In other words, the market is pricing for reflation but no inflation. No overshoot. In addition, the market sees inflation sliding back below the Fed’s target in the longer term, with 10 and 30yr breakevens sliding to 2.17 and 2.15, respectively.

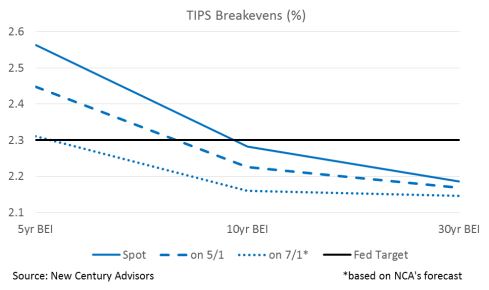

The Fed recently shifted their monetary policy framework, adopting a flexible average inflation target (FAIT) going forward. According to Fed Chair Powell, “following periods when inflation has been running below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.” Given that inflation has run well below their 2% target for years (see chart, below), then if the Fed is to be taken at their FAIT word they won’t hike until inflation runs moderately above 2% for some time. But the TIPS market is not currently pricing in such an overshoot, and as such, there should be no reason for the Fed to hike.

And yet, the market, which until recently wasn’t pricing in the first rate hike until 2024, now looks for as many as three rates hikes in 2023 (chart).

We would argue that either TIPS continue to underprice the upside risk to inflation, or the market is too aggressive in pricing Fed rate hikes. Or possibly both. The investment implications are clear, regardless: we see further upside for the ongoing reflation/inflation trade.

Important Investment Information

Past performance is no indication of future results. There is no guarantee that the investment objective of the strategy will be achieved. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. Clients must be prepared to bear the risk of a total loss of their investment. The themes and strategies and asset allocations herein are not to be construed as commendations. They are for illustration purposes only and subject to change without notice. Returns are presented gross of management fees. Gross returns will be reduced by investment advisors fees. Different methods can be applied to the calculation of performance data. Periods over one year is annualized. The deduction of advisory fees and the compounding effect thereof over time will reduce the total return on any account. For example, an account of $10 million with a 1% fee which experienced a 10% compounding annualized total return over a period of five years would result in an ending dollar value of $16,105,100 without the deduction of advisory fees. If an annual advisory fee of 1% were deducted from the account for the same five year period, the annualized return would be 9%, with an ending dollar value of $15,386,240. Additional information regarding policies for calculation and reporting returns is available upon request. A fee schedule is an integral part of a complete presentation and is described in part ii of the firm’s ADV, which is available upon request. Returns include the reinvestment of dividends and other earnings, where applicable.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. New century advisors believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

The discussion of any investments in this presentation is for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments identified and described do not represent all of the investments purchased or sold for client accounts. The representative investments discussed were selected based on a number of factors including investment process and subject matter applicability. The reader should not assume that an investment identified was or will be profitable. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Certain performance calculations are prepared internally and have not been audited or verified by a third party. The use of a different methodology for preparing, calculating or presenting performance returns may lead to different results and such differences may be material. You may not rely on this presentation as the basis upon which to make an investment decision. Opinions expressed are new century advisor’s present opinions only and are subject

to changes based on market, economic and other conditions and may not actually come to pass. Any historical price(s) or values(s) are also only as of the date indicated.

One cannot invest directly in an index. The index/benchmark comparisons herein are provided for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between client accounts and the indices/benchmarks referenced including, but not limited to, risk profile, liquidity, volatility and asset composition. Benchmark and market data is provided by a third party. New century advisors does not guarantee or warrant the accuracy, timeliness, or completeness of third party information provided and is not responsible for any errors or omissions.

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or proposed by NCA will be profitable or equal any historical performance level(s).

Certain portions of New Century Advisors, LLC newsletters, white papers, etc., may contain a discussion of, and/or provide access to, New Century (and those of other investment and non-investment professionals) opinions and/or recommendations as of a specific prior date. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current opinions and/or recommendation(s). Moreover, no client or prospective client should assume that any such discussion serves as the receipt of, or a substitute for, personalized advice from New Century Advisors, LLC, or from any other investment professional. New Century Advisors, LLC is neither an attorney nor an accountant, and no portion of the content included in this document should be interpreted as legal, accounting or tax advice.

No part of this material or any NCA content may be reproduced in any form, or referred to in any other publication, without the express written permission of the New Century Advisors, LLC